Low Income Tax Offset (LMITO) - Will you be getting $1,080 extra in your tax return?

The million-dollar question, am I getting $1,080??? The short answer is: not necessarily.

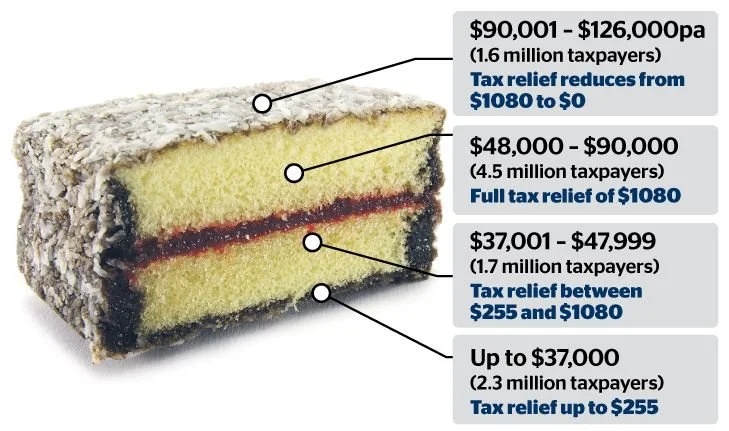

If you earn under $126,000 and have paid tax you will receive an offset between $255 - $1,080.

You MUST have paid tax more than the offset to qualify. The LMITO is a ‘non-refundable’ offset. This means, if you didn’t pay any tax then you will not be getting a refund.

Similarly, if you only paid $100 in tax last year, the absolute maximum you will get back is $100.

How much will I receive then??? There are lots of variables involved and the news is VERY misleading so if you have any questions, please give us a call!

Here are some examples:

• A person earning $35,000 gets $255 back

• $45,000 gets $855 back

• $55,000 gets $1,080 back

• $80,000 also gets $1,080 back

• $100,000 gets $780 back

• $120,000 gets $180 back

Camtech & Slater Financial Group